Get To The Back Of The Line!

You think you own those securities?

In light of the recent engineered trade war and global macroeconomic instability, I felt a sense of urgency to revisit some critical research I did a couple years ago based on The Great Taking by David Rogers Webb.

Click here to access both the full documentary and the free eBook

This may be one of the most important books to read for anyone who thinks they own their equities and debt instruments.

While it’s often stated that 10% of the population owns approximately 80% of the equity markets, this overlooks the fact that a significant portion of the middle class, including retirees and young professionals, have much of their net worth tied up in retirement and pension accounts linked to debt and equity markets even if it is just a small piece of the overall pie.

Every day, an estimated 10,000 Baby Boomers reach retirement age. Many of them are depending on the value of the portfolios they’ve built over a lifetime of work to support them through their retirement years. While younger generations are loaded with debt and struggling to achieve traditional life milestones such as homeownership and starting a family, they too are still deeply reliant on the performance of the traditional financial system to grow their earnings and build any type of wealth they can to outpace the loss of their purchasing power derived from this debt based monetary system.

It’s no secret that the global financial system is one of the primary energy extraction mechanisms used to engineer compliance and dependency, detailed in my most recent piece TOP SECRET: S.W.F.Q.W .

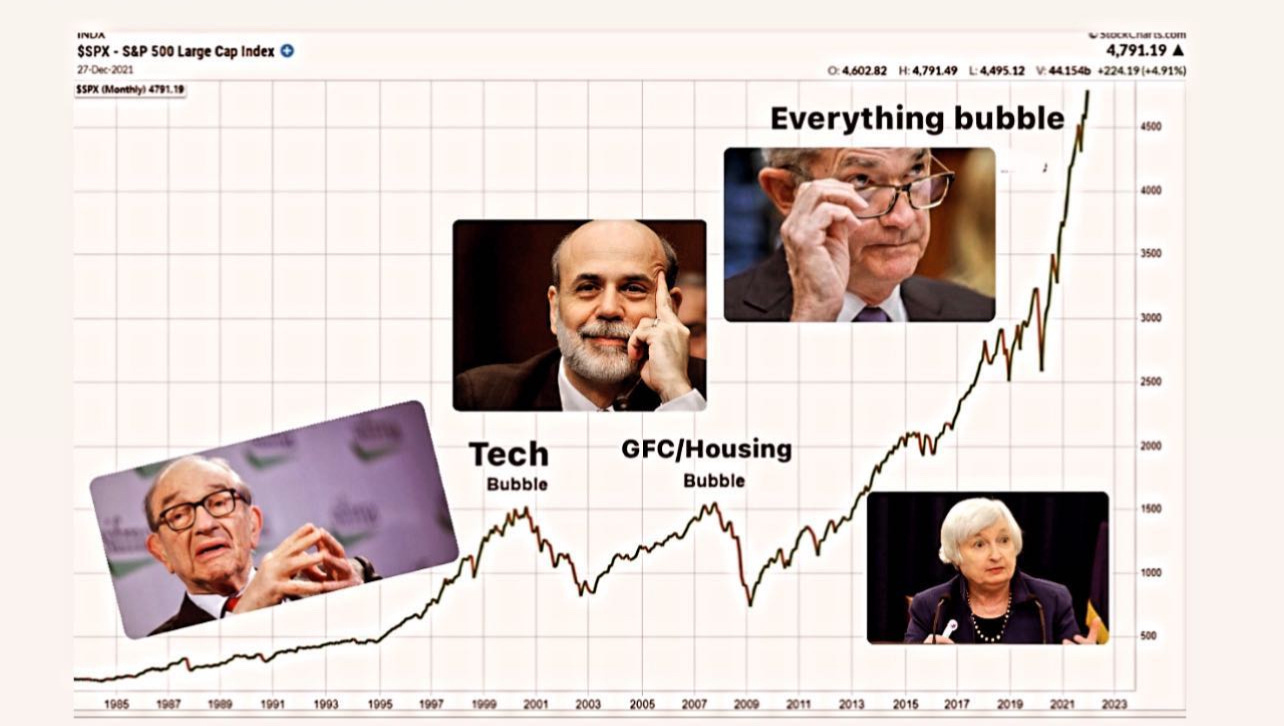

I’ve encountered various sources over the years discussing how the over financialization of Western economies was not a random greed driven evolution, but rather by deliberate design and a means to inflate what’s known today as the “everything bubble”. The intention behind this ultimately would be to collapse the current system at the most opportune time and further consolidate power, ushering in a new system of even more top down control over the global population.

Yet I was missing the pieces on how exactly this transfer of ownership and control would be executed. That gap was filled when I discovered The Great Taking.

This book explores the orchestrated seizure of all collateral at the climax of this globally synchronized debt supercycle. It reveals a long planned and intelligently designed strategy to take control of all financial assets, bank deposits, stocks, bonds and by extension, the property and resources of public corporations. Privately owned property and businesses with any debt are also at risk. If even partly realized, this would represent the largest act of conquest and subjugation in history.

We are living through a hybrid war built on deception folks, and the aim is global conquest not of nations, but of all humanity. Again think of The Silent weapons manual discussed in my last post. This cabal, through private control of central banks and money creation, has gained influence over governments, political parties, intelligence agencies, militaries, police, major corporations, and the media. To the masses this may seem implausible, but the evidence is everywhere for those willing to open their eyes. History offers precedent, Study the eras leading up to the World Wars and the Great Depression and you will see how these were not random events but coldly calculated and made to happen. From these major world events always came major moves toward centralization and consolidation of power into the hands of fewer and fewer people. Today’s push toward a “Great Reset” simply introduces the similar mechanisms used in the past with new technological spins that will further concentrate wealth and power through widespread deprivation.

Remember the World Economic Forum’s vision of a future where "you will own nothing"

Each financial crisis follows a familiar script, the public is blamed for living beyond its means, while regulators and the rest of the pathetic political class are portrayed as well intentioned but helpless. Responsibility is deflected, and the solution offered is always a system reset, promising credit, jobs, and growth. But this time, the price is everything you own. In return, you’ll receive a form of Central Bank Digital Currency on your smartphone just enough to buy milk. There has been major push back on CBDC's which is great to see, but make no mistake they will try other more subtle ways using their front men and women in the “private sector” Think stable coins and the like. The big picture here is programmable money and the elimination of cash.

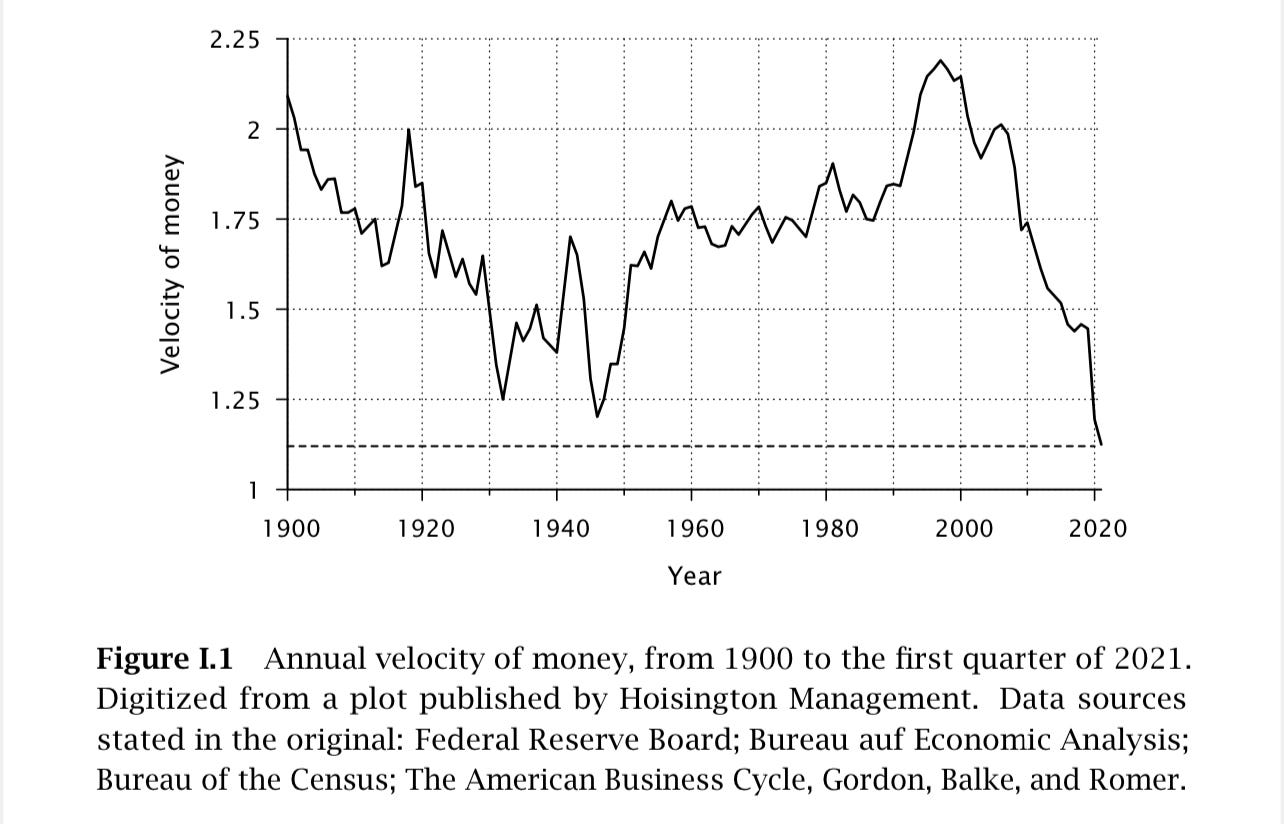

The Silent Weapons manual taught us how a perpetual debt based monetary system with no hard money to back it functions as an excellent system of control. However, The Great Taking does a great job describing how this system deteriorates at the end of a long term monetary supercycle, marked by a collapse in the Velocity of Money (VoM) a process that unfolds over decades. Velocity refers to how frequently a unit of currency is spent on goods and services within a set period. It’s calculated by dividing Gross Domestic Product (GDP) by the Money Supply.

Now I’m all for the funny Fed money printer memes but what most people don’t understand is when the Velocity of Money (VoM) falls, at a certain point even printing large amounts of money fails to sustain economic activity because money isn’t circulating it’s sitting idle instead of being spent. Today we are seeing the return of Volatility and uncertainty derived from the beginning of this global trade war.

Velocity reflects confidence and activity:

A high VoM means people and businesses are actively spending and investing. When VoM drops, it signals fear, uncertainty, or a lack of opportunity so people save or hoard money instead of using it.Printing money ≠ spending money:

Central banks can inject money into the system, but they can’t force people to use it. If businesses don’t invest, and consumers don’t spend, that new money just piles up in reserves or savings accounts.Low VoM breaks the feedback loop:

Normally, one person’s spending becomes another’s income, which fuels more spending. A falling VoM breaks this cycle, money changes hands less, slowing down economic momentum.Confidence, not just cash, drives the economy:

In a low Velocity environment, people are more focused on survival than growth. No amount of printed money can revive the economy if the core issue is distrust, debt overhang, or lack of productive demand.

Bottom line:

Money only fuels the economy when it moves. Printing more of it without addressing why it’s not circulating is like filling a car with gas when the engine won’t turn over. Recency bias has many thinking that the Fed can always just come in and “save the day” as they have in the past, but the day is coming where kicking the can down the road will no longer work.

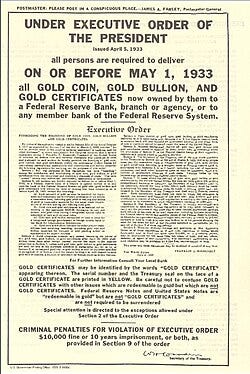

Milton Friedman and Anna Schwartz, in A Monetary History of the United States, observed a sharp decline in the Velocity of Money (VoM) from 1880 to World War I a trend that paralleled the unraveling of global empires and economies. The collapse in VoM preceded monumental events: the fall of the Russian, Austro Hungarian, Ottoman, and Qing empires, the destruction of Germany's economy, the Great Depression, World War II, and the decline of the British Empire. While widespread suffering followed, certain banking interests benefited seizing collateral from failed banks, businesses, and individuals. In the U.S., gold was confiscated from the public. Throughout this upheaval, a small, secretive group retained private control over central banks and money creation, along with influence over key societal institutions like governments, intelligence agencies, corporations, and the media. So I reiterate for those that think “tHis wOuLd nEvEr haPpEn” It has happened and was made to happen. Same playbook, different century.

Those in control of the monetary system have long anticipated another collapse in the Velocity of Money (VoM) and have been preparing to maintain their grip through the coming crisis and "Great Reset" The current decline in VoM, echoing past cycles, began with its peak in 1997, coinciding with the Asian Financial Crisis and followed by the Dot Com crash. During this period, Author David Rogers Webb, then a hedge fund manager, observed how the Federal Reserve influenced markets through Open Market Operations using repurchase agreement (REPOs). This was way before it was cool to call out the Fed and he also talks about how his colleagues at the time considered this a cOnSpIrACy tHeOrY LOL…

David began closely tracking M3, the broadest measure of money at the time, and noticed that in some weeks, new money creation exceeded 1% of the annual U.S. GDP. Yet, GDP wasn’t rising accordingly. This indicated that the Velocity of Money was collapsing: money creation far outpaced economic growth, and the new money wasn’t flowing into the real economy but instead fueling a financial bubble detached from real activity. The author recognized this in real time, and concluded that if he could see it, so could FED chair at the time, Alan Greenspan. This raised a deeper question, were these crises truly accidental? (NO) This led David to the conclusion that they were intentionally induced to consolidate control and prepare for future interventions. By late 1999, as the Dot Com Bubble peaked, money supply growth had surpassed 40% annually, confirming a sharp breakdown in Velocity: money was being created at record levels, but the economy wasn’t responding.

The book shows a chart that reveals a powerful, long-term collapse in the Velocity of Money (VoM) a fundamental force shaping modern history.

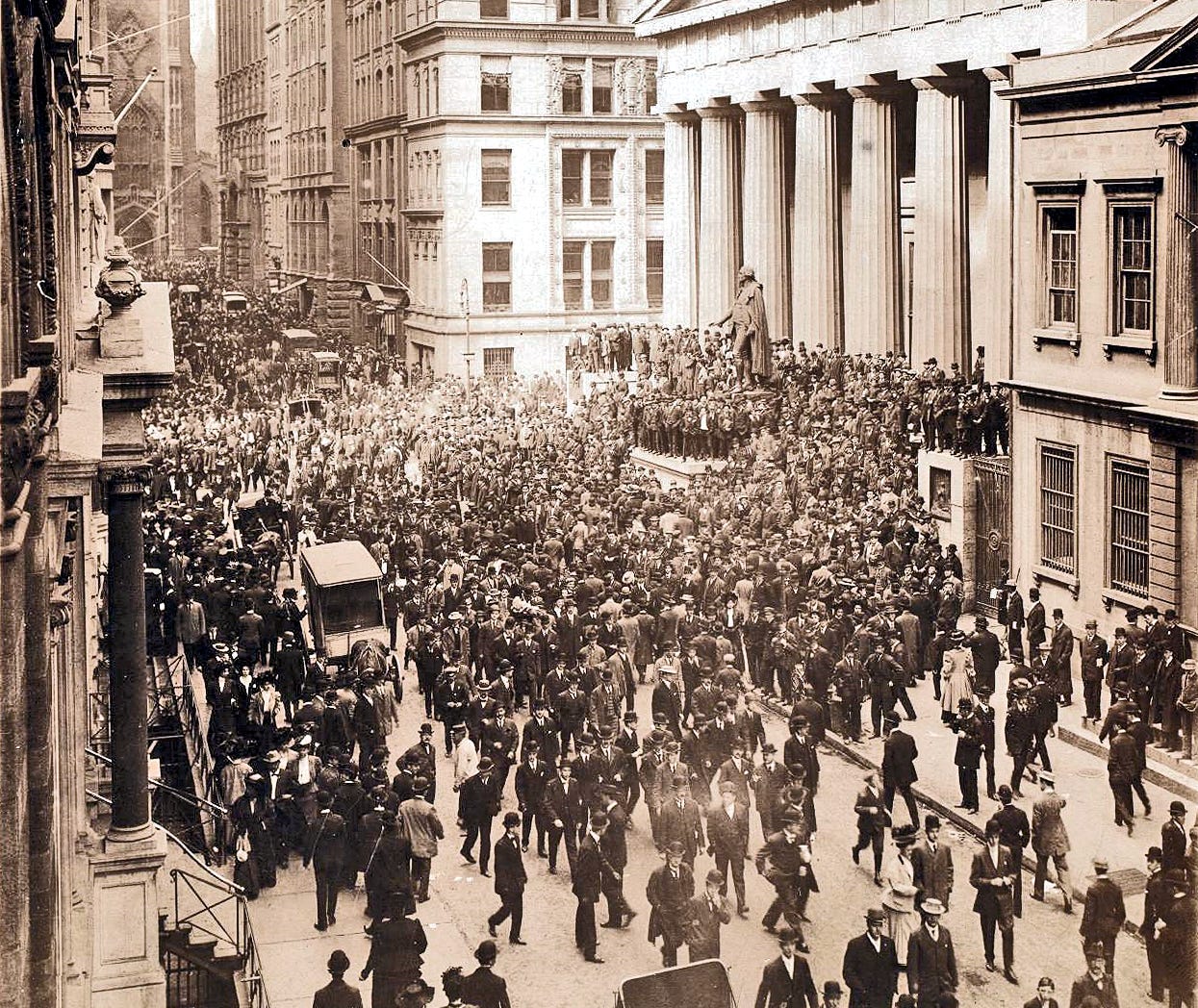

A sharp drop in VoM preceded the Panic of 1907,

which in turn was used to justify creating the Federal Reserve in 1913, just months before World War I began.

While VoM briefly rose during the war, it collapsed again leading to mass bank failures and the confiscation of gold in 1933.

After a short lived recovery during World War II, VoM hit a new low in 1946 and now, it has fallen even lower than during the Great Depression or global wars.

Let’s walk through how we arrived at this.

The book lays out a clear, chapter by chapter progression detailing the mechanisms and milestones that brought us to the brink of systemic asset confiscation.

Starting with Dematerialization

There are now no enforceable property rights to securities held in book entry form anywhere in the world. This loss of legal claim and ownership is a foundational pillar in this global scheme to confiscate collateral. Book entry form refers to a system of recording ownership of securities electronically, without issuing physical certificates. Instead of receiving a paper stock or bond certificate, your ownership is recorded as a digital entry in the books of a custodian, broker, or central securities depository.

No physical certificate is issued.

Ownership is tracked through electronic ledgers.

Your claim is typically a "security entitlement" a contractual right, not a direct ownership of the asset.

Securities are often held in pooled, unsegregated accounts, meaning your specific asset is not individually identifiable.

Why It Matters:

In a book entry system, you don’t directly own the security you own a claim against the entity that holds it (like a broker or clearing house). This has serious implications:

In a bankruptcy, you may be treated as an unsecured creditor.

You may have no legal right to reclaim the specific asset, especially under UCC Article 8 in the U.S.

It opens the door to rehypothecation your asset can be used as collateral multiple times without your consent.

Example:

When you “buy” shares on Robinhood or Fidelity, you don’t actually hold those shares. They're held in book entry form, often at the Depository Trust Company (DTC), and you are listed as a beneficial owner one step removed from the actual security.

The dematerialization of securities or the shift from physical certificates to electronic records was the essential first step.

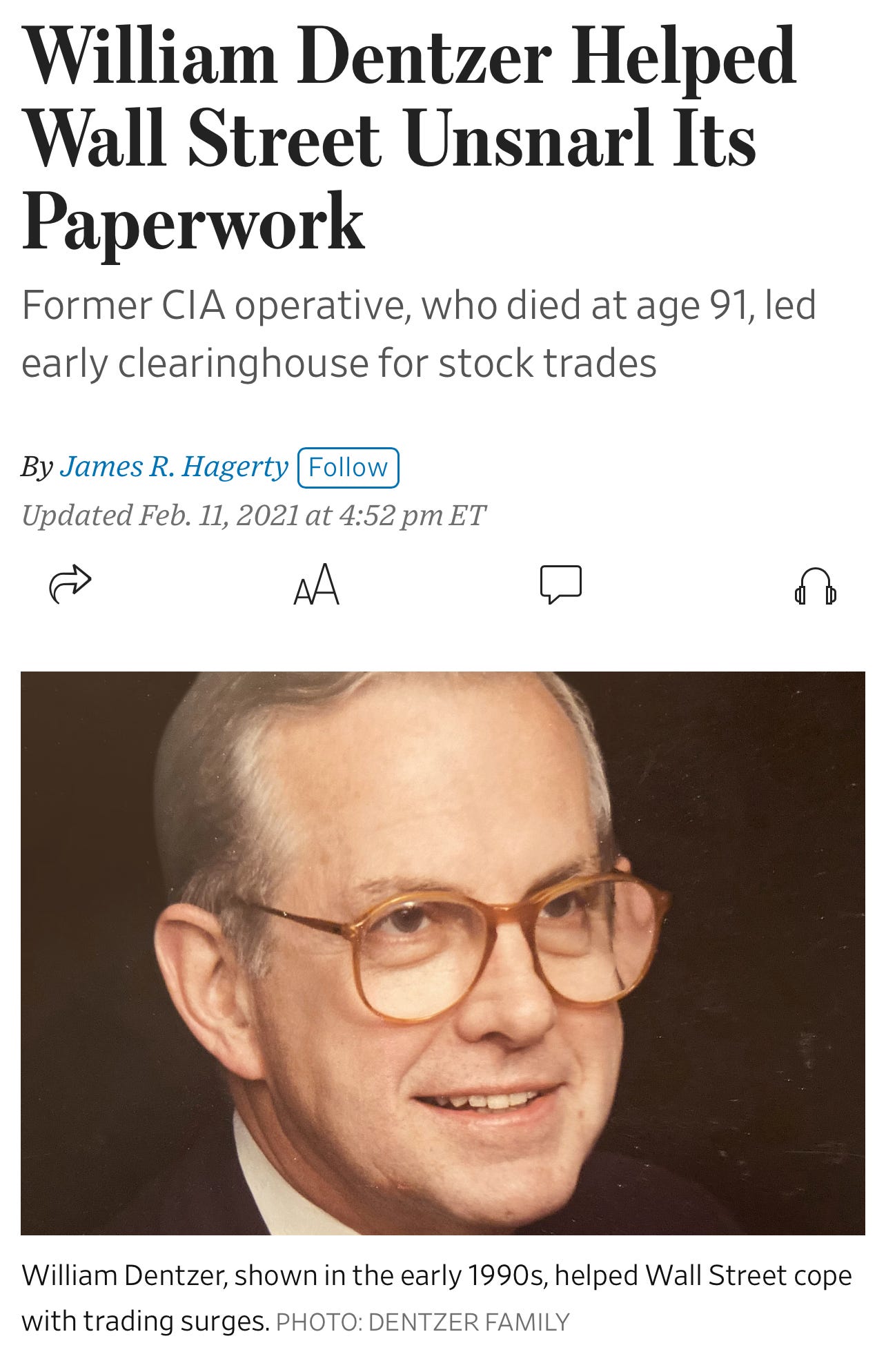

Again think back to my Silent Weapons For Quiet Wars post, This initiative was not organic. It was orchestrated with deep state involvement going back over 50 years. The project was led by William Dentzer, Jr., a career CIA operative who, despite having no financial background, was appointed New York State Superintendent of Banks and then made Chairman and CEO of the Depository Trust Corporation (DTC) the very institution tasked with centralizing securities under book entry form.

Dentzer oversaw the DTC for 22 years, guiding the entire dematerialization process. The push began in the late 1960s with the Banking and Securities Industry Committee (BASIC), which cited a sudden "paperwork crisis" as the reason to shift away from physical stock certificates. This crisis prompted lawmakers to call for government intervention, resulting in the DTC’s creation in 1973.

However, the narrative is questionable. Markets continued to operate effectively for years before dematerialization was broadly implemented. With available computing power, the so called crisis could have been managed suggesting the “paperwork crisis” was likely manufactured to justify centralizing and digitizing securities. To reiterate, this allowed for the elimination of legal ownership and the transformation of all securities into controllable claims under centralized custody.

Security Entitlement

Now while you may still believe you own assets like stocks or bonds, in reality many of these are pledged as collateral by others. Legal structures are now in place that allow powerful financial entities to seize this collateral immediately,

not because you defaulted, but because of the insolvency of those who pledged your assets without your knowledge. (Read this as many times as it takes)

This applies to all tradable financial instruments worldwide (except bitcoin, more on this later) a fact that is legally and structurally undeniable.

Most public securities, held in custodial accounts, pension plans, and investment funds are already entangled in the global derivatives system, which is so massive it dwarfs the global economy many times over. A key feature of this system is hypothecation and rehypothecation, where the same client collateral is reused or pledged repeatedly by different creditors. These insiders, aware of the system’s fragility, have demanded even greater access to client held assets as collateral.

With the inevitable collapse of the “Everything Bubble”, this collateral is set to be swept up on a massive scale. The infrastructure and legal certainty are already in place, allowing seizure without judicial review, by entities legally designated as “the protected class.” Even sophisticated investors who were told their assets were “segregated” will not be safe.

This outcome is the result of decades of deliberate planning, beginning in the U.S. with changes to the Uniform Commercial Code (UCC) in all 50 states. These quiet legal amendments, done without the need for Congressional approval were specifically designed to subvert property rights and prepare for this unprecedented asset grab.

in simple terms

You don’t legally "own" your securities anymore, you have a weak contract claim called a "security entitlement" that offers little protection if your broker or bank goes under.

All securities are held in pooled, unsegregated accounts, whether or not you’ve agreed to let yours be used as collateral.

If there’s insolvency, everyone gets only a share of what’s left, even if you opted out of collateral use.

You’re not allowed to reclaim your own securities if the account provider fails this is called “revindication,” and it's legally blocked.

Brokers and banks can legally use client securities from the pool for their own trades and financing.

"Safe Harbor" laws give lenders first rights to your pooled assets before you, the actual account holder.

Courts have upheld this system, giving secured creditors top priority over individual investors.

Harmonization

I plan to do a post in the future on the explosive rise in financialization and how it came to be, but for now just understand that It was not random but very much by design to serve a purpose:

To create both the threat of collapse and the lure of profit as tools to herd nations into compliance.

A legal framework was established to give certain secured creditors guaranteed rights to client assets worldwide, with fast, cross border control over collateral. This system began in the U.S. after the dot com bust and was pushed globally under the banner of “harmonization” a term that masked its harmful implications.

Central to this effort was the Hague Convention (drafted in 2002, signed in 2006), which aimed to eliminate legal barriers in cross border securities transactions. It introduced the PRIMA rule (“Place of the Relevant Intermediary Approach”), which allows legal jurisdiction to be set by the account agreement bypassing national laws that might otherwise protect asset owners. This ensured creditors’ claims could override ownership rights, and that no country’s laws could stand in the way.

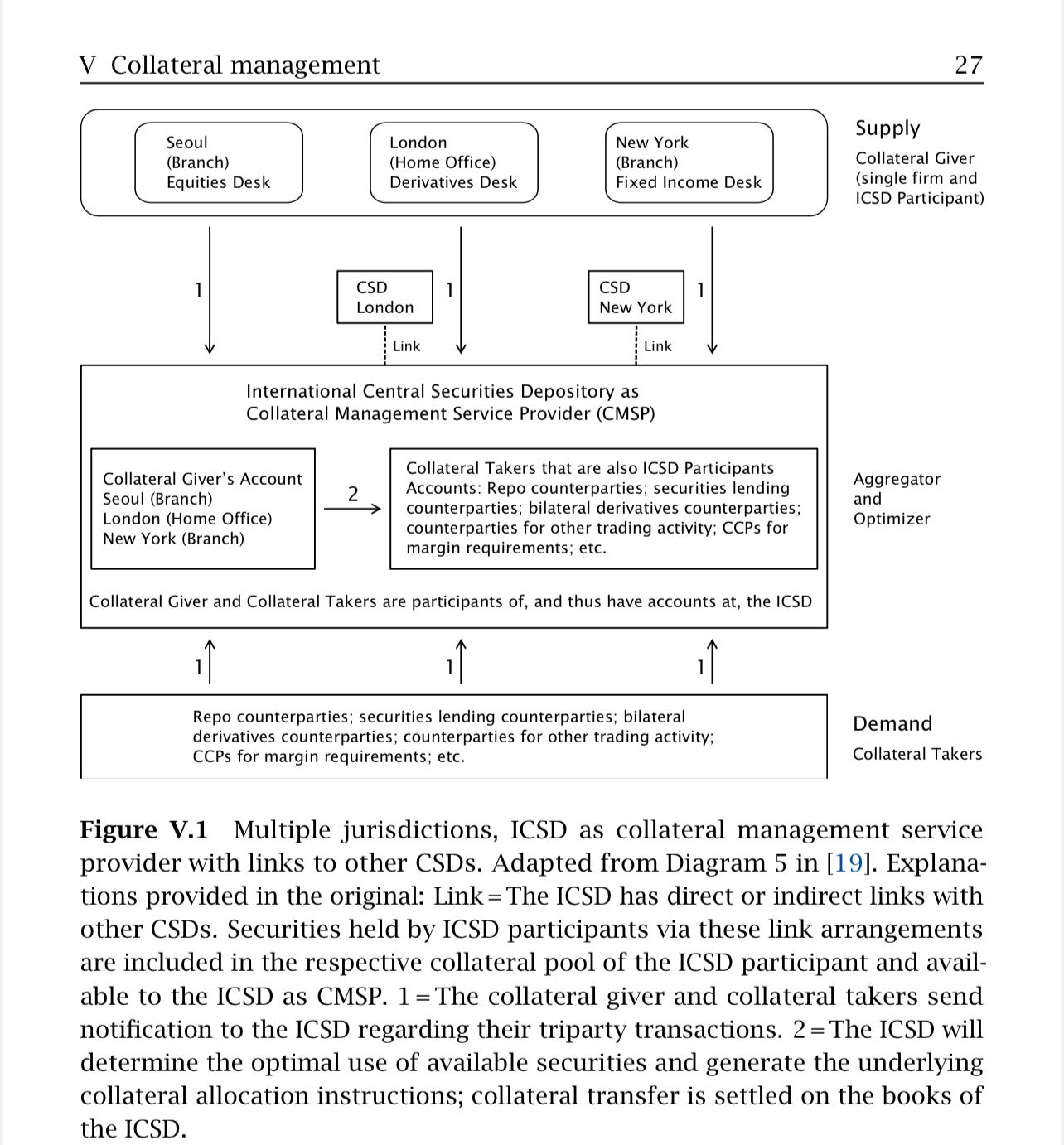

Collateral Management

A global collateral management system has been deliberately built to move securities across borders through linked networks of CSDs (Central Securities Depositories), ICSDs (International CSDs), and CCPs (Central Clearing Counterparties). These CCPs concentrate the risks of the vast derivatives market, and the system ensures that, when CCPs inevitably fail, pre selected secured creditors can seize the collateral without legal challenge.

Following the bursting of the “Everything Bubble”, an “Everything Crash” will trigger widespread insolvency. The collateral management systems will then automatically transfer client assets to CCPs and central banks, completing the planned seizure.

This infrastructure is the culmination of decades of financialization. The resulting crash will be devastating, leaving no country or financial system untouched, and ensuring no pockets of resistance or resilience remain. The trap is set.

In case you want to understand why Derivatives are so dangerous read quick summary below.

🔹 What Are Derivatives?

Derivatives are financial contracts whose value is based on (or "derived from") an underlying asset like a stock, bond, interest rate, or commodity. Examples include:

Options

Futures

Swaps (especially interest rate swaps and credit default swaps)

🔹 How Risk Becomes Concentrated

Sheer Size of the Market:

The notional value of the global derivatives market is estimated in the hundreds of trillions of dollars far larger than the global economy.

Even though not all of that is “at risk” at once, the interconnectedness makes even a small disruption ripple across the system.

Counterparty Risk:

Derivatives are often bilateral agreements between two parties. If one party defaults, the other is exposed.

This creates a chain of liabilities if one major firm fails, it can trigger failures across many others (systemic risk).

Use of Leverage:

Derivatives often involve high leverage, meaning participants control large positions with little upfront capital.

Small market movements can cause huge gains or losses, rapidly magnifying risk.

Central Clearing Counterparties (CCPs):

Post 2008, many derivatives are cleared through CCPs, which are meant to reduce systemic risk by standing between buyers and sellers.

However, this also centralizes the risk if a CCP fails, the entire market could seize up.

CCPs require collateral ("margin") from participants. In a crisis, these margin demands spike, triggering forced asset sales and liquidity shortages.

Interdependence with Collateral:

Derivatives require collateral to be posted often securities held in pooled accounts.

This means that when derivative positions implode, they can trigger automatic seizure of real assets.

🔹 Why This Is Dangerous

The derivatives system is complex, opaque, and tightly interwoven.

Losses or defaults can cascade through the financial system.

Because CCPs and large banks are at the center of the web, a failure there could be catastrophic, affecting not just finance but real economies worldwide.

📌 Bottom Line:

The derivatives market concentrates financial risk into a small number of institutions (like CCPs and megabanks) and depends on fragile chains of collateral and trust. When things go wrong, they go wrong everywhere, fast which is why many consider it the most dangerous part of the global financial system.

Safe Harbor

for Whom, and from What? (LEGAL PRECEDENT HAS BEEN SET)

In 2005, just before the Global Financial Crisis, major changes were made to the U.S. Bankruptcy Code’s “safe harbor” provisions.

These changes were designed to protect secured creditors not customers by making it impossible to challenge their seizure of client assets, even in bankruptcy.

Before the amendments, certain asset transfers could be reversed if they were considered fraudulent or preferential (e.g., made shortly before bankruptcy or without equivalent value).

The 2005 amendments removed these protections for clients in the case of derivative related contracts (e.g., swaps, repos, forwards), effectively legalizing asset grabs by large financial institutions.

Legal and Systemic Implications:

Stephen Lubben, legal expert, noted that the changes:

Gave blanket protection to nearly all derivatives.

Applied only to large financial institutions (“protected persons”) excluding smaller firms or individuals.

Were justified by the systemic risk argument: that unwinding derivatives in bankruptcy could trigger financial collapse.

Real World Case: Lehman Brothers & JPMorgan

JPMorgan, as custodian for Lehman client assets, took those same assets as a secured creditor right before Lehman's collapse.

This would have been illegal under previous law, but under the 2005 safe harbor amendments, JPMorgan’s actions were protected.

The court sided with JPMorgan, citing the need for “market stability” and reinforcing safe harbor protections.

The decision cemented legal precedent: only members of the “protected class” (large financial institutions) can take client assets in this way, with absolute priority.

Final Outcome:

After the 2008 crisis, no executives were prosecuted for using or losing client assets.

Instead, case law was established affirming that protected financial institutions can legally seize client assets, even during financial distress or bankruptcy.

This marked a historic shift in property rights, where customer protections were subordinated to the interests of systemic players.

Central Clearing Parties (DESIGNED TO FAIL)

Role and Risk of CCPs (Central Clearing Parties):

CCPs act as intermediaries in trades involving derivatives, securities, and FX assuming risk if one party defaults.

CCPs consolidate all exposure from clearing members, putting that risk on their own balance sheet.

This makes CCPs a central point of failure in the financial system.

Growing Concern Over CCP Failure:

Euroclear (ICSD) channels collateral to CCPs, centralizing risk even further.

Even industry insiders at Euroclear’s 2020 conference admitted that:

Risk is now highly concentrated in CCPs.

Regulations are not aligned globally.

There is growing tension over who pays if a CCP collapses.

EU insists taxpayers won’t foot the bill implying secured creditors will seize assets.

Regulatory Blind Spots:

Reports by the Financial Stability Board (FSB) and BIS avoided key crisis scenarios:

No modeling of system wide contagion.

No analysis of simultaneous defaults across multiple CCPs.

Assumed all non defaulting parties continue to function normally an unrealistic assumption in crisis.

DTCC: Systemically Critical, but Under Capitalized

DTCC runs multiple CCPs in the U.S., all designated Systemically Important Financial Market Utilities (SIFMUs).

Despite handling the entire U.S. securities and derivatives market, DTCC’s total equity in 2023 was only $3.5 billion a tiny cushion for such systemic exposure.

Legal Position: Clients Are Last in Line

If DTCC CCPs fail, secured creditors have priority over entitlement holders (i.e., regular investors and firms).

This has been acknowledged explicitly by the New York Fed and was cemented into law in court during the Lehman Brothers case.

Planned CCP Collapse and Recovery Model:

DTCC openly discusses pre funding for a new CCP to be spun up when an old one fails.

Losses will be covered not by CCP capital, but through loss allocation to members and by seizing collateral.

The goal is to ensure continuity without legal challenge to creditors’ claims even if it means the public loses assets.

DTC (Depository Trust Company) Model:

Most U.S. broker-dealers are DTC participants.

All securities are held in pooled “fungible bulk”, meaning no one owns specific shares only pro rata claims.

This makes it easier to seize and reallocate assets in a systemic collapse.

🔻 Bottom Line:

The global financial infrastructure is deliberately structured to concentrate risk in CCPs, while legally protecting secured creditors at the expense of individual investors and smaller firms. These CCPs are undercapitalized by design, and a pre-planned collapse and replacement process is already in place. In any future crisis, the collateral sweep will be immediate, legal, and irreversible, leaving the public exposed and the “protected class” in control.

So there we have it, a clearly laid out decades long, coordinated legal and financial restructuring that has quietly stripped individuals of true ownership over their assets.

Starting with dematerialization the shift from physical certificates to digital book entry systems under the guise of efficiency, which eliminated direct property rights to securities.

Followed by the creation of the security entitlement framework, replacing ownership with a weak contractual claim within a pooled system controlled by intermediaries.

Global harmonization efforts then enforced this model internationally through treaties and regulations like the Hague Securities Convention and EU directives, ensuring that all jurisdictions conformed to U.S. style creditor protections.

Enter collateral management, the infrastructure linking central securities depositories (CSDs), international CSDs (ICSDs), and central clearing counterparties (CCPs), creating a system that automatically sweeps assets into the hands of secured creditors upon market failure. At the center of this framework sit the CCPs, entities designed to absorb and mutualize systemic risk, yet they themselves have become the great concentration points of fragility, undercapitalized and poised to fail by design. This structure ensures that when the inevitable crisis hits, the CCPs will collapse, triggering an automatic legal transfer of collateral to the “protected class” of secured creditors.

Safe harbor laws sealed the trap granting these creditors absolute legal priority in bankruptcy, immune from challenge, even when asset transfers would previously have been deemed fraudulent. Through this architecture, the global financial elite have positioned themselves to legally seize all pledged collateral in the coming systemic collapse leaving the public, once again, at the back of the line.

Fortunately, humanity has Bitcoin the ultimate defense against engineered confiscation and financial subjugation.

Bitcoin stands alone as the apex predator of finance: the hardest money ever created, the strongest form of property rights known to man, and the only form of pristine collateral that operates entirely outside the legacy financial architecture designed for systemic seizure.

When self-custodied correctly, Bitcoin is a true bearer asset. It is not entangled in custodial layers, not dependent on alphabet soup institutions like CSDs, ICSDs, or CCPs and not subject to legal constructs like security entitlements or safe harbor provisions. Ownership is enforced by private keys and cryptography not intermediaries, or centralized ledgers.

In a world where every other asset can be vacuumed into the hands of secured creditors through harmonized legal triggers, Bitcoin remains the one asset that cannot be encumbered, seized, or controlled if held properly. It is the sovereign firewall against the Great Taking.

I’ll be expanding on this topic in a future post, but for now, know this: we have options to operate outside the system. And no matter how dark it gets, there will always be people like myself and hopefully you the reader who refuses to bend the knee, no matter what they throw at us, We will win.